AfCFTA: An Opportunity for Meaningful Reform on Corruption Toward Further Attracting American Investments to the Continent by Guest Writers

June 25, 2020 AfCFTA / africa / American / Anti-corruption / China / Commerce / Companies / FCPA / Free Trade Act / FTA / International / Kenya / Laws / markets / Trade / UK / USA / USTR

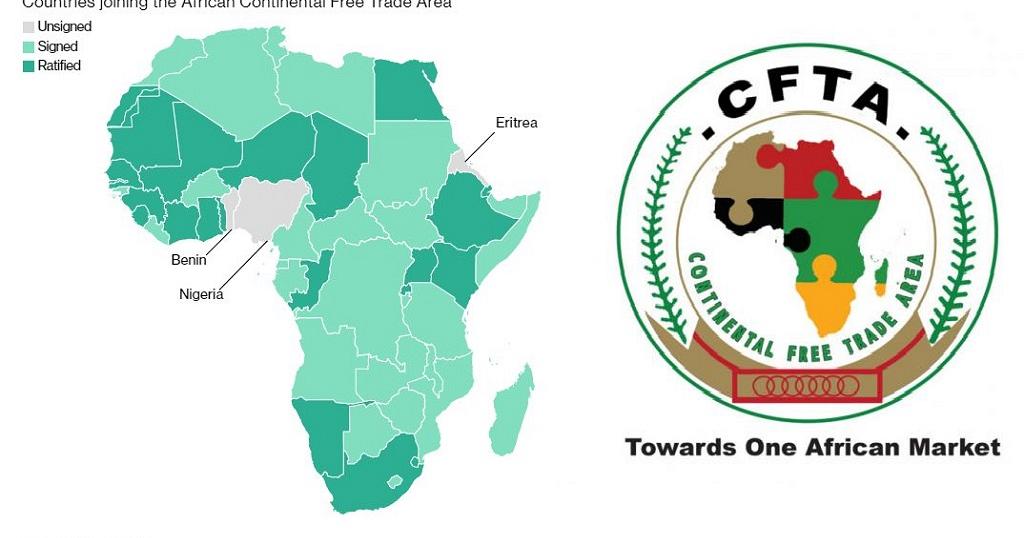

Amid the COVID-19 pandemic, the African continent has seen challenges like other parts of the world that are affecting trade. This includes a moving effective date for the African Continental Free Trade Agreement (AfCFTA), which slid from July 1 to possibly January 1, 2021, to avoid distracting African leaders as they respond to the pandemic. Nevertheless, there is a push to have the continent move forward with implementation of the AfCFTA, to spur further collaboration and intra-Africa trade, which in turn could help the continent better weather economic downturns related to the global pandemic. The AfCFTA, once implemented, will create a $3.4 trillion economic bloc, which would provide Africa with increased leverage in the global economy.

Phase II negotiations of the AfCFTA have also been delayed. If Africa truly desires increased U.S. investments, there needs to be more proactive and expansive action on addressing corruption at all levels in the second phase of the AfCFTA talks. This should include expanding the traditional focus on public-sector corruption to providing incentives that dissuade private-sector corruption in the Phase II negotiations. Corruption is widely regarded as corrosive to trade facilitation, particularly when bribes are sought throughout the transiting of goods within countries and as they cross borders. Moreover, American companies examine corruption issues and related costs in their risk assessments when considering whether to enter African markets.

Earlier this year, the United States announced bilateral trade negotiations with Kenya toward a possible free trade agreement. These talks will help better inform African countries of American companies’ concerns in sub-Saharan Africa. For example, the U.S.-Kenya trade negotiation objectives, which solicited input from American stakeholders, includes a chapter on anti-corruption (Among other things, the Office of the U.S. Trade Representative is to seek to “Secure provisions committing Kenya to criminalize government corruption, to take steps to discourage corruption, and to provide adequate penalties and enforcement tools in the event of prosecution of persons suspected of engaging in corrupt activities.”). American companies are also looking for a level playing field.

Unlike Chinese and Russian counterparts, American investors are held to enforceable U.S. laws when operating abroad. This includes the Foreign Corrupt Practices Act (FCPA) of 1977, which prohibits U.S. citizens and entities from bribing foreign government officials overseas to benefit their business interests. AfCFTA negotiators should examine the FCPA and the United Kingdom’s Bribery Act 2010 and at a minimum include provisions in a Phase II agreement that raise the bar for all foreign investors that operate on the continent with respect to anti-corruption, including Chinese and other investors not beholden to the UK or U.S. anti-bribery laws. Moreover, the AfCFTA could further move the needle on anti-corruption by enacting tools that provide enforceable provisions that address private sector corruption. A FCPA-like law and regulations governing private sector corruption collectively could create a better environment for doing business across the continent, as well as provide a more level playing field for foreign investors in general; thereby attract U.S. investors that have shied away from some African markets due to corruption and related concerns.

By our Guest Writers

Stacy A. Swanson and Frank Samolis